Step-by-Step Process for Registering a Startup in Singapore

Step-by-Step Process for Registering a Startup in Singapore

Your complete guide to legally registering a startup in Singapore in 2025. Learn the essential steps, documents, fees, and compliance requirements to fast-track your business incorporation and access one of Asia’s most vibrant startup ecosystems.

Table of Contents

- Introduction: Why Register Your Startup in Singapore?

- Key Benefits of Singapore Startup Registration

- Choosing the Right Legal Structure

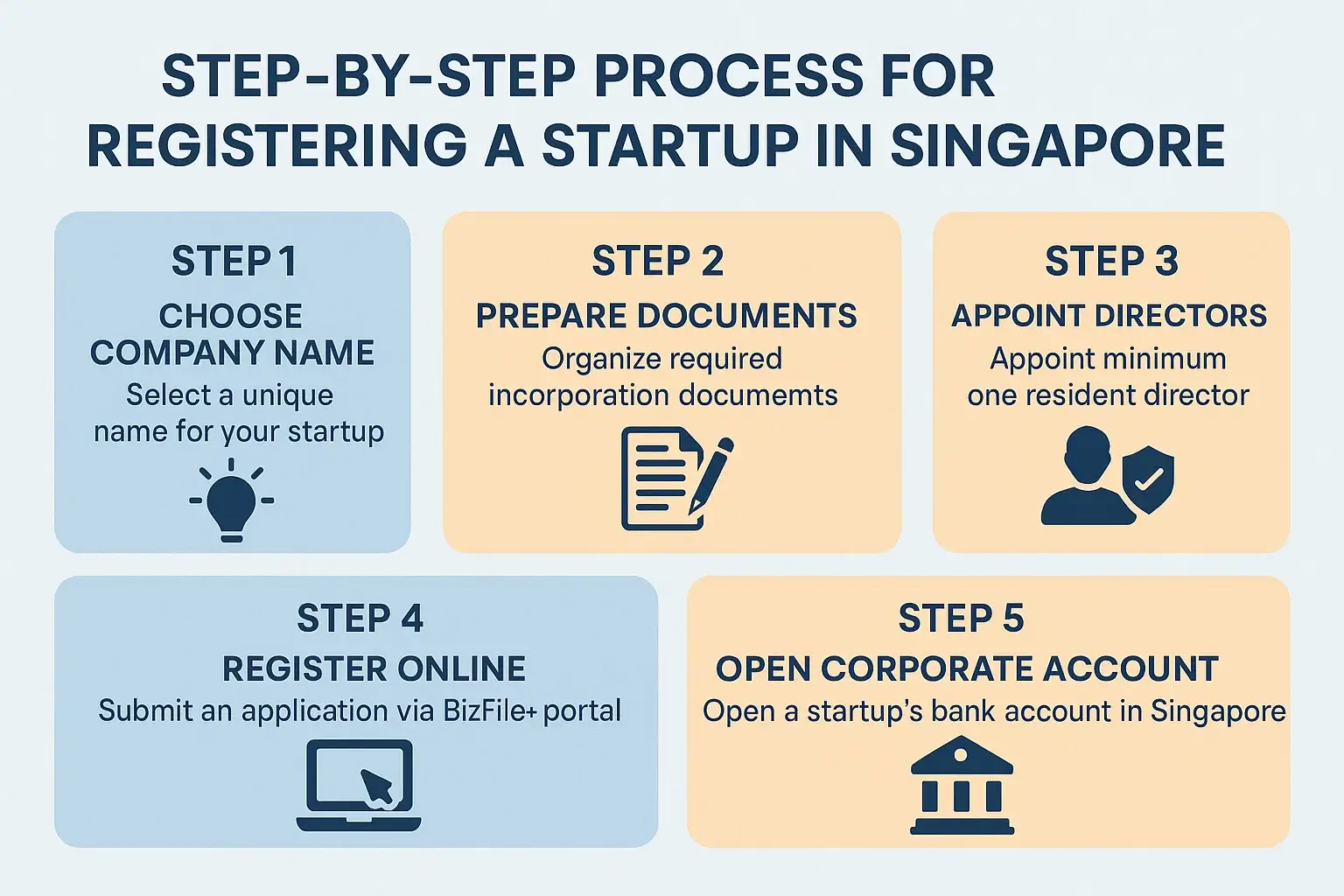

- Step 1: Name Reservation and Approval

- Step 2: Preparing Required Documents

- Step 3: Filing Your Incorporation Application

- Step 4: Post-Incorporation Compliance

- Singapore Startup Registration Fees Explained

- Tax Incentives and Grants for New Startups

- Common Mistakes to Avoid During Registration

- Frequently Asked Questions

- Conclusion

Introduction: Why Register Your Startup in Singapore?

Singapore has rapidly emerged as one of Asia’s premier startup hubs, offering a business-friendly environment, strong legal framework, and access to global markets. Registering your startup in Singapore in 2025 unlocks competitive advantages such as favourable tax regimes, grants, and an extensive network of investors and accelerators. Whether you’re a tech innovator, fintech entrepreneur, or e-commerce pioneer, mastering the Singapore business registration process is your first step toward success.

Key Benefits of Singapore Startup Registration

- Robust Legal Protection: Limited liability companies protect personal assets from business risks.

- Access to Funding: Eligibility for government grants and venture capital investment.

- Tax Advantages: Competitive corporate tax rates and startup tax exemptions.

- Ease of Doing Business: Streamlined online registration with the Accounting and Corporate Regulatory Authority (ACRA).

- Regional Market Access: Strategic location with strong trade and logistics infrastructure.

Choosing the Right Legal Structure

Selecting the appropriate legal entity is critical. The most common options for startups include:

- Private Limited Company (Pte Ltd): Most popular for startups due to limited liability and corporate tax benefits.

- Sole Proprietorship: Suitable for very small or one-person startups with less regulatory compliance.

- Partnership: Between 2-20 partners, offering shared management but unlimited liability for partners.

- Limited Liability Partnership (LLP): Combines partnership flexibility with limited liability protection.

For most fast-scaling startups, registering as a Private Limited Company is recommended for investor readiness and growth flexibility.

Step 1: Name Reservation and Approval

The first step is to select and reserve your company name via ACRA’s online platform (BizFile+). Guidelines include:

- The name cannot be identical or too similar to existing entities.

- Must avoid infringement on trademarks or contain prohibited words (e.g., “bank”, “government”).

- Name approval typically takes minutes to a few hours unless manual review is required.

Choose a distinctive, memorable name that reflects your brand identity and complies with Singapore"s legal standards.

Step 2: Preparing Required Documents

To register your startup, prepare these essential documents:

- Company Constitution: Sets out rules of governance. You can use the standard constitution or customize one.

- Details of Directors: At least one director must be a Singapore resident (Citizen, PR, or EntrePass holder).

- Shareholders Information: Minimum one shareholder, who can be an individual or corporate entity.

- Registered Address: Must be a local Singapore address (residential addresses not allowed for commercial use).

- Identification Documents: NRIC for Singaporeans/PRs, passport for foreigners.

Precise, error-free documentation expedites the incorporation process and reduces rejection risk.

Step 3: Filing Your Incorporation Application

Submit your application online via BizFile+. The process includes:

- Uploading the prepared documents and company constitution.

- Paying the registration fee (see fee section).

- Choosing share structure and details of shareholders and directors.

- Confirming the registered office address and date of commencement.

Typically, successful incorporation certificates are issued within 1 day if no complications arise.

Step 4: Post-Incorporation Compliance

After incorporation, startups must:

- Open a corporate bank account with a Singapore bank.

- Register for Goods and Services Tax (GST) if annual turnover exceeds SGD 1 million.

- Appoint company secretary within 6 months (mandatory for Pte Ltd).

- Hold the first Annual General Meeting (AGM) and prepare audited financial statements (if required).

- Apply for necessary business licenses or permits related to your industry.

Timely compliance ensures smooth business operations and regulatory adherence.

Singapore Startup Registration Fees Explained

Here’s a breakdown of the usual fees associated with registering a startup in Singapore:

- Name Application Fee: SGD 15 per application.

- Company Registration Fee: SGD 300 for private limited companies.

- Additional Services (optional): Professional corporate secretary services (~SGD 600/year), registered office address (~SGD 240/year).

Many startups opt to engage company incorporation service providers for streamlined processing and compliance assistance, adding nominal service fees.

Tax Incentives and Grants for New Startups

Singapore offers attractive tax incentives for qualifying startups:

- Start-Up Tax Exemption (SUTE): Exemption on the first SGD 200,000 of chargeable income for the first three years of assessment.

- Productivity Solutions Grant (PSG): Subsidizes IT solutions and equipment to improve productivity.

- Enterprise Development Grant (EDG): Supports projects related to business upgrading and innovation.

- Global Innovation Alliance (GIA): Enhances access to overseas innovation ecosystems.

These programs provide startups with critical financial relief and growth support — eligibility depends on sector and business activities.

Common Mistakes to Avoid During Registration

- Choosing an inappropriate legal structure that limits scalability.

- Submitting incorrect or incomplete documents leading to delays or rejections.

- Failing to appoint a Singapore resident director on time.

- Using non-compliant company names or violating trademark rights.

- Neglecting post-incorporation statutory requirements like secretary appointment and filing annual returns.

Frequently Asked Questions

Q1: How long does it take to register a startup in Singapore?

In most cases, incorporation completes within 1 working day after document submission and payment.

Q2: Can foreigners register a startup in Singapore?

Yes, but at least one director must be a Singaporean resident or hold an EntrePass.

Q3: Is a registered office address required?

Yes, all companies must have a local Singapore address as their registered office.

Q4: Can I change my company name after registration?

Yes, you can apply to change it via ACRA’s BizFile+ portal subject to approval.

Q5: What are ongoing compliance requirements?

Maintain a company secretary, hold AGMs, file annual returns, and adhere to tax filing deadlines.

Conclusion

Registering your startup in Singapore in 2025 unlocks access to a dynamic market, investor ecosystem, and business incentives unmatched in Asia. By following the clear, step-by-step Singapore startup registration process, preparing accurate documentation, and understanding your legal and tax obligations, you set a firm foundation for your venture’s success.

Ready to launch? Begin your company name reservation today and join Singapore’s thriving startup community.

Comments (3)