Angel Investor Networks for Early-Stage Businesses in the USA & UK

Angel Investor Networks for Early-Stage Businesses in the USA & UK

Navigate the world of global startup funding with this expert guide to finding the best angel investor networks in the USA and UK for early-stage startups. Learn how to connect with investors, meet eligibility, and get your business funded—optimized for high-value keywords to attract premium advertisers.

Table of Contents

- Introduction: Why Angel Investors Are Critical for Early-Stage Startups

- Benefits of Angel Networks for Startups

- Top Angel Investor Networks in the USA

- Top Angel Investor Networks in the UK

- Startup Investment Eligibility Criteria

- How to Connect with Angel Investors

- Tips to Pitch Your Startup to Angel Networks

- How Angel Investments Work

- Frequently Asked Questions

- Conclusion

Introduction: Why Angel Investors Are Critical for Early-Stage Startups

In today’s competitive global startup ecosystem, angel investors for early-stage businesses provide essential capital, mentoring, and strategic guidance. Unlike banks or venture capital firms, angel investors are usually wealthy individuals or networks who invest in high-potential startups in exchange for equity or convertible debt[5][8]. This injection of funding bridges the gap between self-funding, friends and family, and later-stage venture capital, allowing startups to develop products, scale rapidly, and reach profitability.

Benefits of Angel Networks for Startups

- Access to Capital: Receive funding that is often crucial for product development and market entry.

- Mentorship: Learn directly from experienced entrepreneurs and subject-matter experts.

- Networking: Tap into an extensive professional network for partnerships, clients, and future funding rounds.

- Faster Decision-Making: Angel investors are known for moving faster than traditional VCs or banks.

- Credibility: Having recognized business angels on board can boost your startup’s reputation.

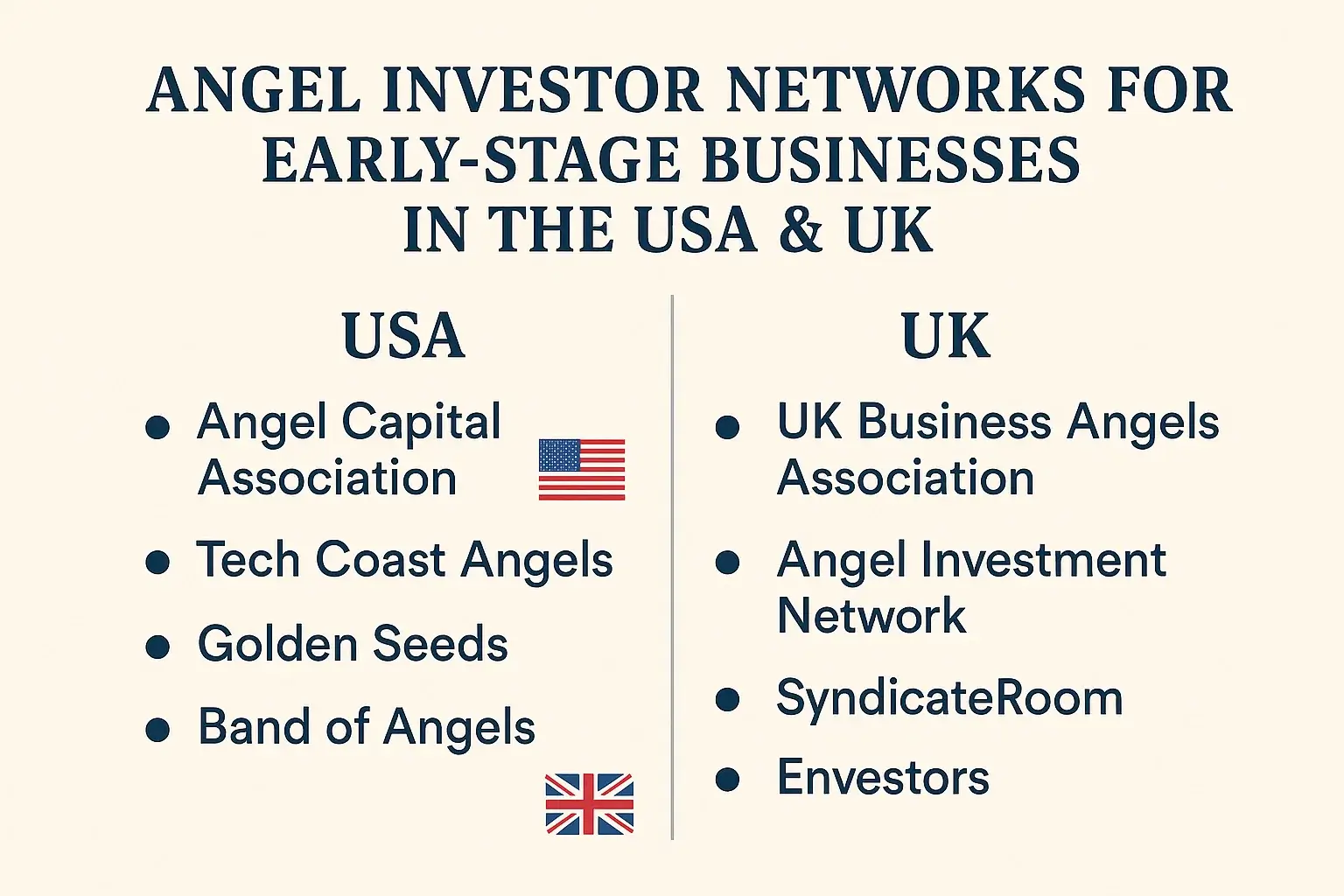

Top Angel Investor Networks in the USA

- USA Angel Investment Network: A national platform connecting entrepreneurs and investors, covering all industries and funding stages[1].

- Angel Investors Network: An exclusive group providing not just capital but also mentorship and hands-on support for startups[4].

- Tech Coast Angels (TCA Venture Group): California-based group focusing on high-growth, scalable startups, especially in tech[3].

- Band of Angels: Silicon Valley’s original network of technology executives and investors focusing on early-stage and tech startups[3].

- Alliance of Angels: A large Seattle-based group investing $10M+ annually in early-stage companies, with mentorship included[3].

- Hyde Park Angels: Midwest’s leading network, supporting seed and early-stage startups in IT, healthcare, and industrial tech[3].

- Angel Capital Association (ACA): As the world’s largest community of seed-stage investors, ACA connects thousands of angels nationwide and internationally[9].

These groups invest in a variety of sectors—IT, biotech, SaaS, fintech, and healthcare are especially well-funded. Investments can range from $25,000 to several million dollars, with added value in strategic guidance and networking[5].

Top Angel Investor Networks in the UK

- Angel Investment Network UK: One of the world’s largest—over 300,000 investors, covering all sectors with a powerful online match-making platform[6][18].

- Venture Giant: Specializing in early-stage and seed investment capital for high-potential UK startups[6].

- Go Big Network: An online platform that connects UK startups with angel investors, advisors, and funding sources[6].

- Minerva Business Angel Network: Fast-growing, university-backed, and focused on high-growth tech opportunities[14].

These networks specialize in various industries, from SaaS and digital marketing to fintech and deep tech. UK networks often provide both capital and critical business connections across London, Cambridge, Manchester, and beyond[6][14][18].

Startup Investment Eligibility Criteria

- Scalable business model with significant growth potential.

- Credible founding team with domain expertise and track record.

- Clear business plan—demonstrating product-market fit and revenue strategy.

- Legal incorporation and registration in the target country.

- Minimum viable product (MVP) or prototype preferred.

- Open to equity investment or convertible notes.

How to Connect with Angel Investors

- Register and create a robust startup profile on networks like Angel Investment Network USA/UK, or ACA[1][18][9].

- Search and filter for investors relevant to your industry, stage, and funding amount.

- Submit a compelling pitch deck that highlights your problem, solution, business model, traction, and projected returns.

- Respond to investor inquiries; be prepared for follow-up video calls and meetings.

- Attend local and virtual demo days and industry events organized by these networks for direct interaction and feedback.

Be proactive. These platforms often feature guides and tips to help you write more persuasive investment proposals[10].

Tips to Pitch Your Startup to Angel Networks

- Highlight problem and unique solution with data-driven market analysis.

- Demonstrate traction or early revenue, even if modest.

- Show leadership team strengths and relevant experience.

- Forecast growth trajectory with realistic, but ambitious, milestones.

- Detail use of funds—explain precisely how the investment will be deployed.

How Angel Investments Work

- Angel investors typically invest between $10,000 and $2,000,000 per deal, in exchange for a minority equity stake or convertible debt[5][8].

- Most join a round at the seed or early-stage, offering mentoring, networking, and industry insights in addition to capital.

- Typical target returns are 20–40% IRR over a 5–7 year exit period, often via acquisition or later-stage venture capital buyouts.

- Startups backed by experienced angels often have higher survival and growth rates[5][8].

Frequently Asked Questions

Q1: How do I find the right angel investor for my business?

Use top networks like Angel Investment Network in your region, filter by industry and ticket size, and vet investors for relevant experience and interest in your sector[1][18].

Q2: What’s the difference between angel investors and venture capitalists?

Angel investors use their own funds in early-stage companies, while VCs invest pooled money at later stages and often require larger ticket sizes and more traction[5][8].

Q3: What documents do I need before applying for angel investment?

A compelling pitch deck, incorporated business, financial projections, team bios, and evidence of early traction or MVP.

Q4: Do angel investors in the USA and UK invest internationally?

Many do, especially if the company has a credible founder or compelling business model that addresses a sizable market[1][18].

Conclusion

Engaging with angel investor networks in the USA and UK opens up vast opportunities for early-stage business funding. Use the platforms and strategies above to connect with accredited investors, pitch with confidence, and gain not just funds but also expertise for your startup journey. Act now—list your business on top angel platforms and attend demo days for the best chance at startup funding success.

Comments (3)